PERMODALAN ASSAR SDN BHD

CORPORATE GOVERNANCE

1. Overview

Among the core values subscribed to by PASB is INTEGRITY – embodied by its motto of seeking to do “what is right” in all aspects of our operations. PASB is cognizant of the importance of embracing the pillars of corporate governance such as ethical behavior, accountability, transparency and sustainability in providing a framework for managing the organization.

In this regard, PASB is committed to upholding this value and adhering to best practices of corporate governance. This being to ensure that there is a proper framework of structures and control mechanisms to manage the business operations and support the affairs of the company towards achieving its goals for the benefit of stakeholders including employees, clients, customers and for the greater good of the wider society.

2. Foundation steeped in Governance

Against the backdrop of having structures, systems and procedures, PASB has endured till this day since its incorporation in 1994.

Tapping into the established supervisory functions of internal audit and compliance from its subsidiaries in the highly regulated financial services sector, the internal audit function was extended to PASB and its other subsidiaries in 1999. One of the earliest measures to ensure good governance and to provide assurance on internal controls and compliance was for such functions to be supported by the Sub-Board Audit Committee; with its dedicated Charter and Terms of Reference.

Similarly, risk management initiatives were extended to PASB-level in early 2009 following the establishment of a designated Risk Management function in 2008. In order to provide oversight over risk management implementation, a Sub-Board Risk Management Committee was established. Initially premised on COSO Internal Controls Framework, risk management has evolved over the years from being operational in perspectives into a more holistic enterprise-wide approach.

In line with thematic developments and focus over the years, policies have been gradually introduced to address issues such as personal data protection, cybersecurity, bribery and corruption.

3. Enhanced Governance Framework

In seeking to achieve sustainable profitability and financial growth, PASB had also recently embarked on a corporate governance reform i.e. to strengthen its existing governance framework. It has adopted various initiatives which facilitate its Board of Directors in discharging its oversight and stewardship functions as well as assist Management in the day-to-day running of the organization. Amongst these initiatives are:

- revamped corporate structure;

- revised organizational and governance structures demarcating clear lines of authority

- policy improvements for procurement, delegation and limits of authority

- reinforcing proper culture and good behavior through revisions of Code of Ethics, Anti-Bribery & Anti-Corruption Policy and introduction of a distinct Whistleblowing Policy

- introduction of new policies for sound financial management i.e. investment and dividend policies and procedures

- establishment of group business continuity measures

- introduced new remuneration grading system in managing talent/human resources and review of performance measurement system

- establishment of Group Sustainability Policy

Other initiatives are ongoing such as re-branding and new digitalization plans.

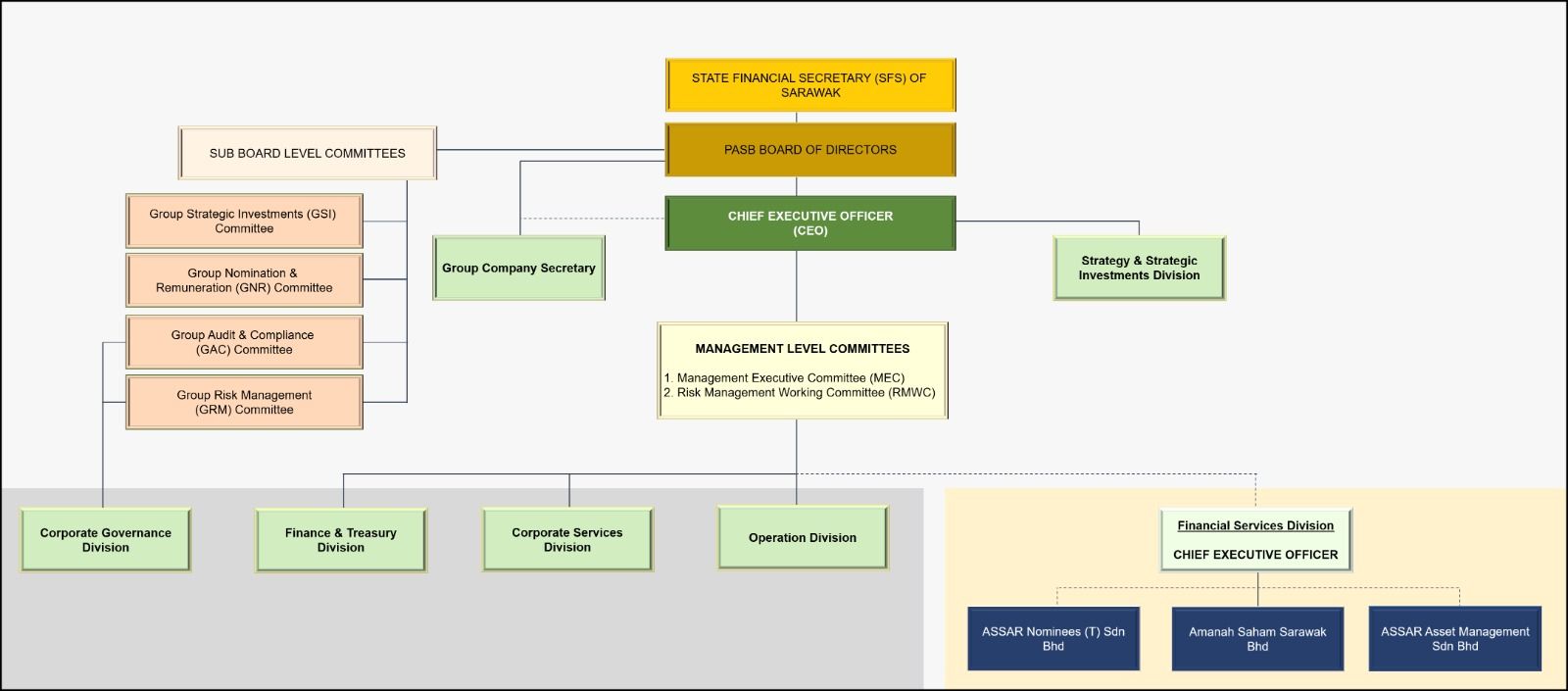

4. Corporate Governance Structure

The corporate governance structure of PASB is such that there is clear delineation of authority and responsibility; with the Board of Directors reporting to the ultimate Shareholder, while being supported by various Sub-Board Committees, Management-level Committees and Working Committees for their respective functions.

5. Governance & Integrity

For more information, please click on the link below to view, download or print.

Note: You will need Adobe Acrobat Reader in order to view or print the documents. If you do not have it, you can download it from Adobe Acrobat Reader which is free of charge.: